6+ Georgia Pay Calculator

Web Documents that include the names of more than 100 people connected to Jeffrey Epstein including business associates and accusers among others have now been made public following a federal. Web House Democrats released evidence that he took in at least 78 million from foreign entities while in office engaging in the kind of conduct the GOP.

Natico Multifunctional World Time Clock Calendar India Ubuy

Web Georgia Paycheck Calculator.

. Web Utilizing the Hourly Paycheck Calculator for Georgia involves a few simple steps. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. Use this useful tool to simplify your payroll process and ensure compliance with Georgia state laws.

Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Use iCalculator USs paycheck calculator tailored for Georgia to determine your net income per paycheck. Is grasping to pin on President Biden.

Web Below are your Georgia salary paycheck results. Web The state income tax rate in Georgia is progressive and ranges from 1 to 575 while federal income tax rates range from 10 to 37 depending on your income. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator.

Web Calculate your income tax in Georgia and salary deduction in Georgia to calculate and compare salary after tax for income in Georgia in the 2024 tax year. 47809 Annual Monthly Biweekly Weekly Day Hour 2226 Total Tax 7774 Net pay Salary 6149700 Federal Income Tax - 562014. This paycheck calculator can help estimate your.

Web With this calculator you can easily determine the gross pay net pay and withholdings for your employees based on their salary hourly rate and other relevant information. Please verify accuracy of information and calculations prior to actual use of payroll data. Web Average monthly salary in Georgia is GEL 1180month USD 397 approx up until the second quarter of 2019 it went all time high of GEL 12025month in the last quarter of the year 2018.

Salary frequency How often. Georgia has a 61 chance of winning. Lets look at it as a whole.

Web To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Just enter the wages tax withholdings and other information required below and our tool will take care of the rest. Web Fill out our contact form or call.

State Where are you employed. Simply input salary details benefits and deductions and any other necessary information as prompted below and let our tool handle the rest. State Filing status Self-employed.

Salary How much do you get paid annual. Web Federal and state tax rates and limits are subject to change without notice. 877 729-2661 to speak with Netchex sales and discover how robust our reporting is providing invaluable insights to your business.

Tax year Job type Salaryhourly wage Overtime pay. Web Georgia Paycheck Calculator. Web Use our simple paycheck calculator to estimate your net or take home pay after taxes as an hourly or salaried employee in Georgia.

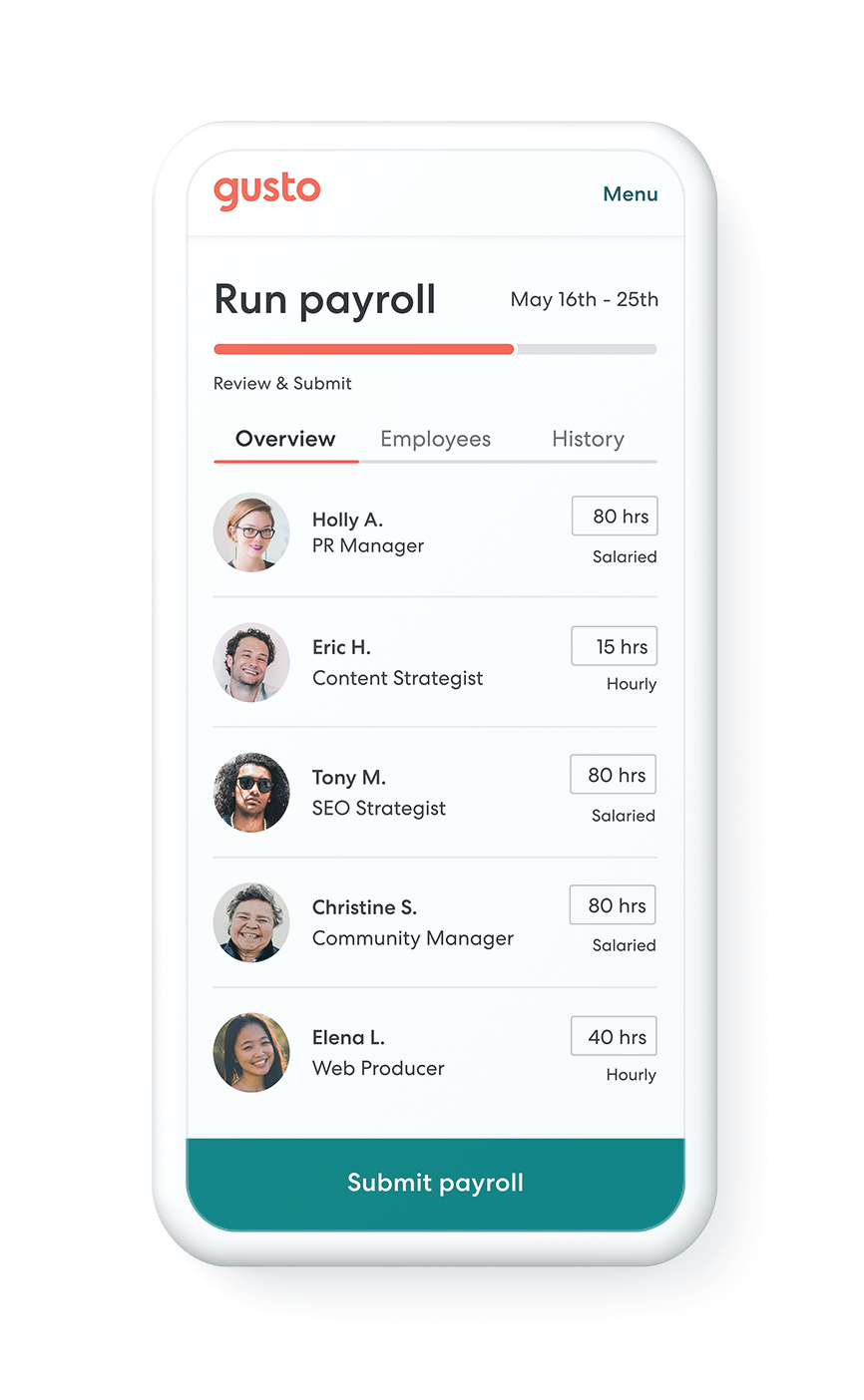

To understand how to calculate federal state and local. Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Georgia. The results are broken up into three sections.

Calculate paycheck in Georgia estimate state payroll taxes and federal withholdings SUI and SDI in Georgia using our payroll calculator for GA. Web Paycheck Calculator Georgia - GA Tax Year 2024. Paycheck Calculator Calculate Tax Pay breakdown Your estimated take home pay.

Web Georgia Paycheck Calculator Calculate your take home pay after federal Georgia taxes Updated for 2023 tax year on Dec 05 2023 What was updated. By using Netchexs Georgia paycheck calculator discover in just a few steps what your anticipated paycheck will look like. If you are driving the length of the turnpike.

Web A 5 increase that was approved by the Turnpike Commission begins Sunday for all E-ZPass and toll-by-plate customers. States dont impose their own income tax for tax year 2023. There is a noticeable difference in the average salary that is earned by Men and Women.

Real median household income adjusted for inflation in 2022 was 74580. Web Georgia payroll tax rates. Web Use Georgia Paycheck Calculator to estimate net or take home pay for salaried employees.

Include any relevant deductions such. Web Federal Paycheck Calculator Photo credit. Overview of Georgia Taxes Georgia has a progressive income tax system with six tax brackets that range from 100 up to 575.

Web Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Georgia paycheck calculator. Men earn comparatively higher average wages than women. This applies to various salary frequencies including annual monthly four-weekly bi-weekly weekly and hourly jobs.

Use ADPs Georgia Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Input your hourly wage which is the rate you are paid for each hour of work. Indicate the number of hours worked during the pay period whether weekly bi-weekly or monthly.

Pay frequency Additional withholdings. Use our paycheck tax calculator. Last Updated on January 04 2024 Enter your period or annual income together with the necessary federal state and local W4 information into our free online Georgia paycheck calculator to determine your net pay or take-home pay.

The calculator accurately accounts for federal state and local taxes alongside standard. According to the ESPN Matchup Predictor the Georgia Bulldogs have a 610 chance of beating the Florida State Seminoles in the Capital One Orange Bowl. Web Georgia Paycheck Calculator For Salary Hourly Payment 2023 Curious to know how much taxes and other deductions will reduce your paycheck.

Georgia companies and employees each pay a 62 Social Security tax plus a 145 Medicare tax under the states payroll tax system. A 765 unemployment tax is also paid by employers. Well do the math for youall you need to do is enter the applicable information on salary federal and state W.

Mcgee Collins Pc Richmond Hill Ga

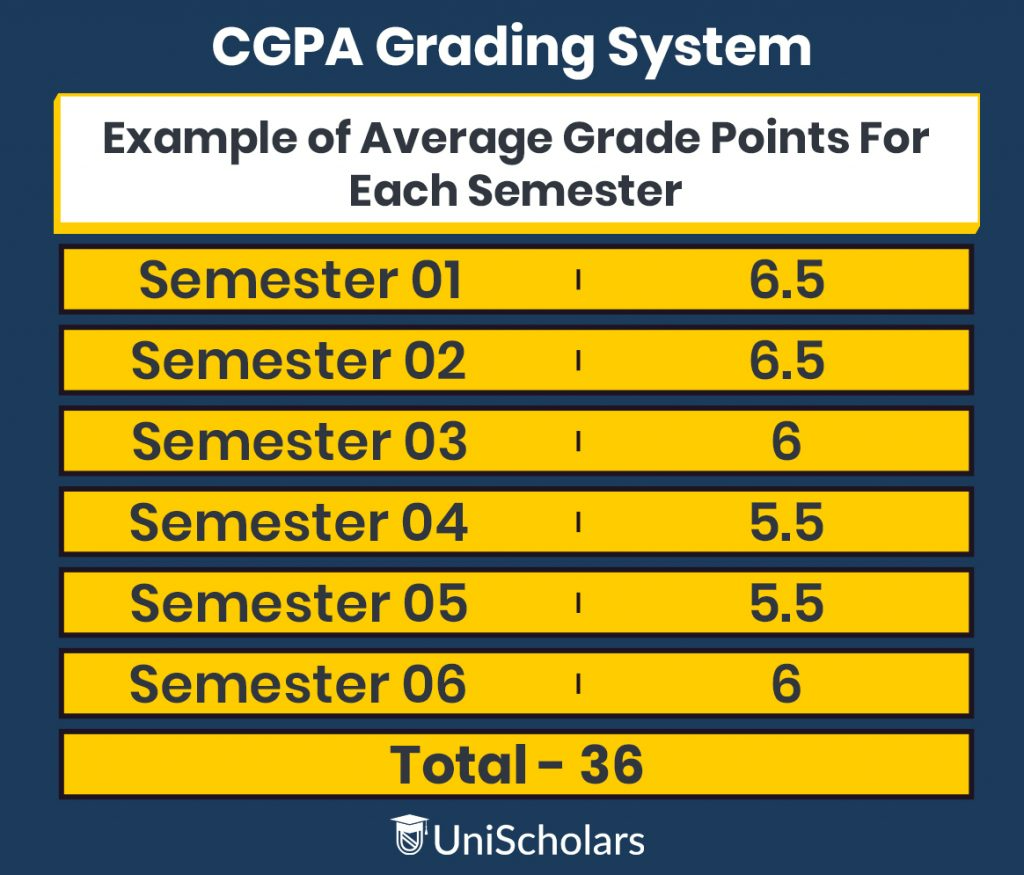

A Guide On 10 Point Cgpa To 4 Point Gpa Conversion Unischolars

Medical Record Copying Fees By State Record Retrieval Solutions

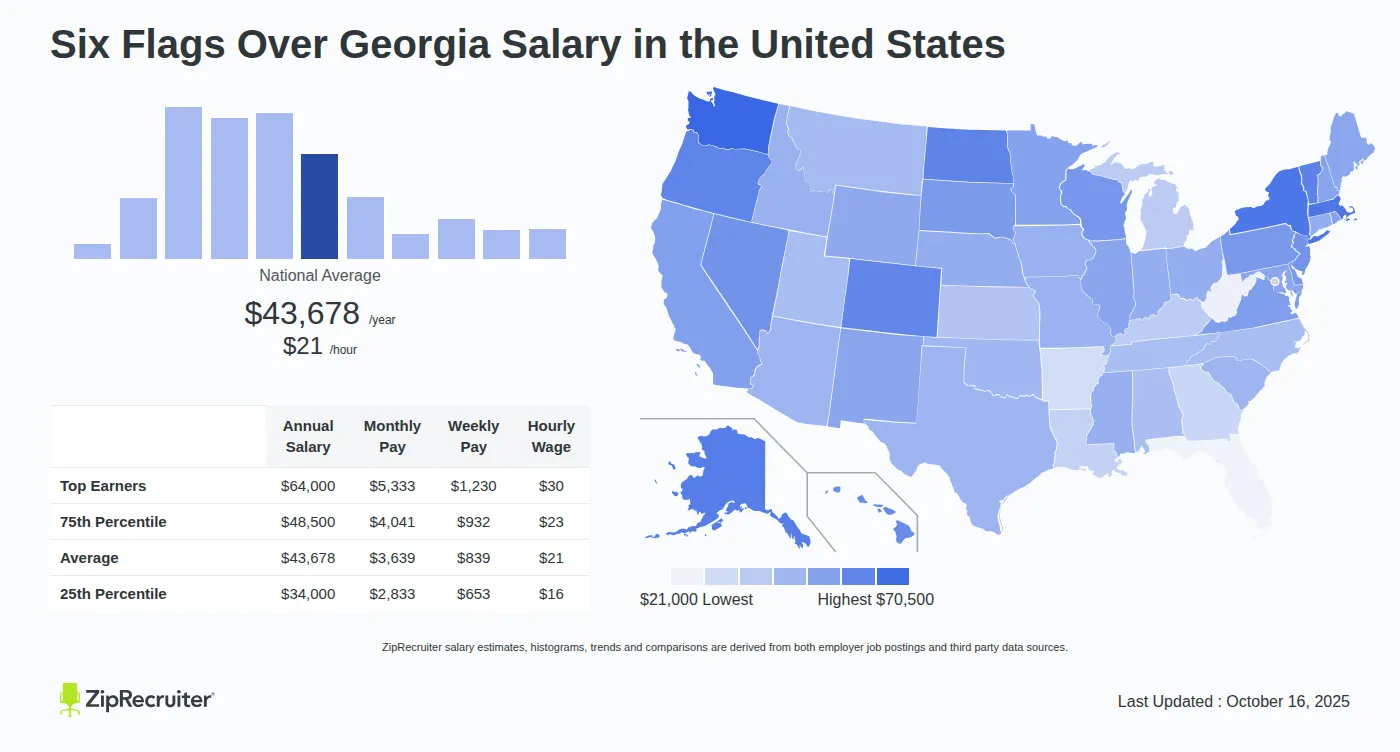

Six Flags Over Georgia Salary Hourly Rate January 2024

Georgia Paycheck Calculator Calculate Your Net Pay

Net Working Capital Formula 2023 The Comprehensive Guide

Georgia Salary Calculator 2024 25

Georgia Paycheck Calculator Smartasset

Casio G Shock Sportliche Farbserie Der 90er Jahre Gelbes Harzarmband Ga 110y 9aer First Class Watches Deu

Pocket Calculator With Lanyard 12 Unit 3006 J 13 Studentsupply Com

Sec Championship Odds How To Bet On Georgia Vs Alabama In The Sec Championship Game

Georgia Hourly Paycheck Calculator Ga 2023 Tax Rates Gusto

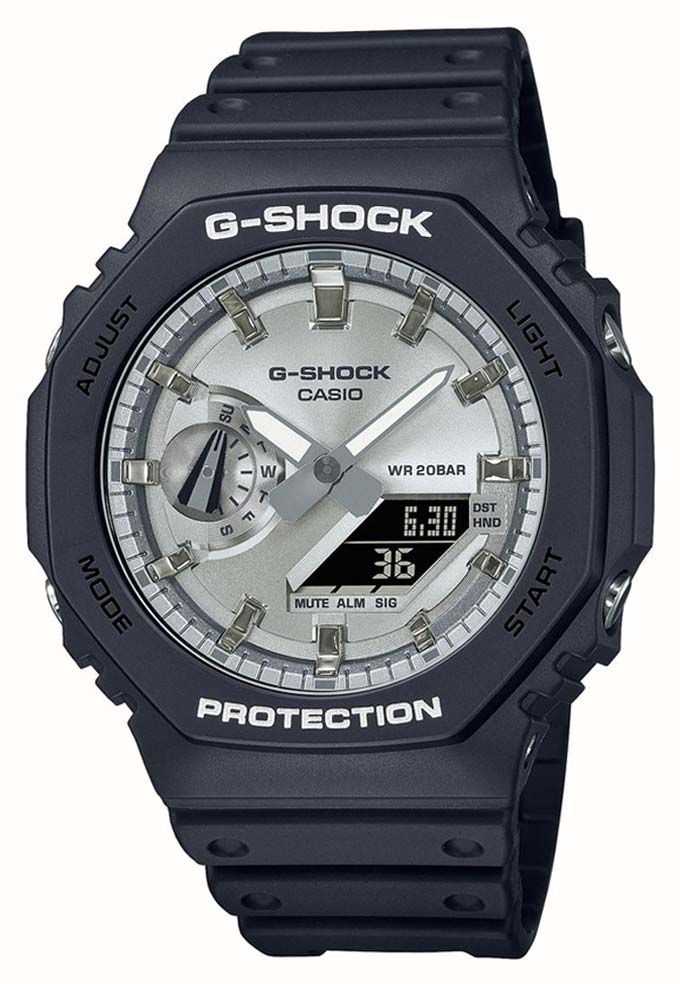

Casio G Shock Ga 2100 Grelles Silbernes Zifferblatt Der Octagon Serie Ga 2100sb 1aer First Class Watches Deu

How To Calculate Child Support In Ga 2023

Salary Six Figures In Georgia January 2024

6 Thousand Credit Card Us Royalty Free Images Stock Photos Pictures Shutterstock

Georgia Paycheck Calculator Adp